Core features

Achieve operational excellence from day one without any additional development.

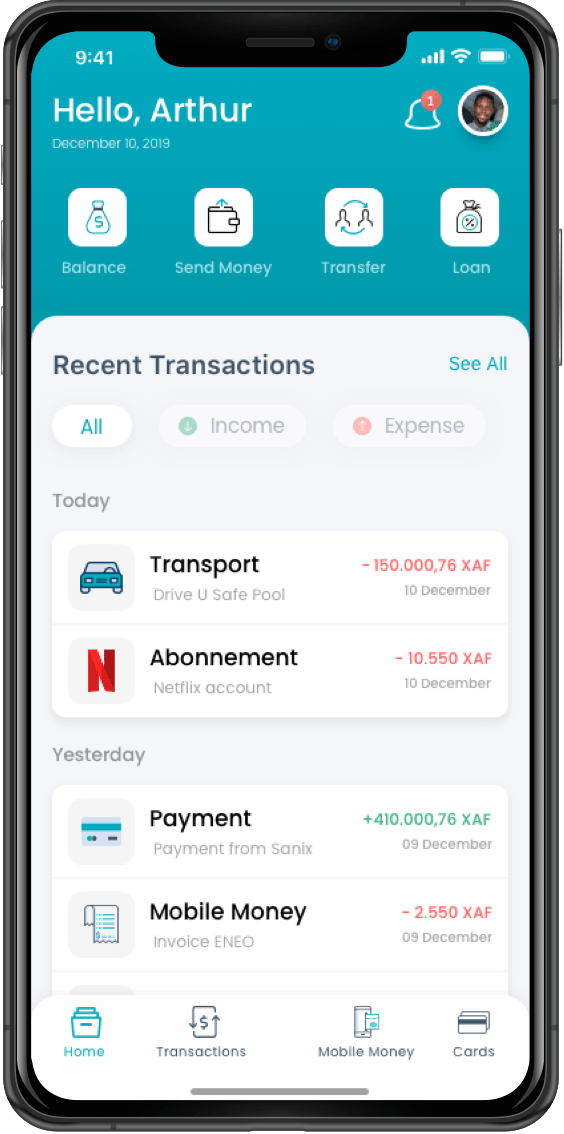

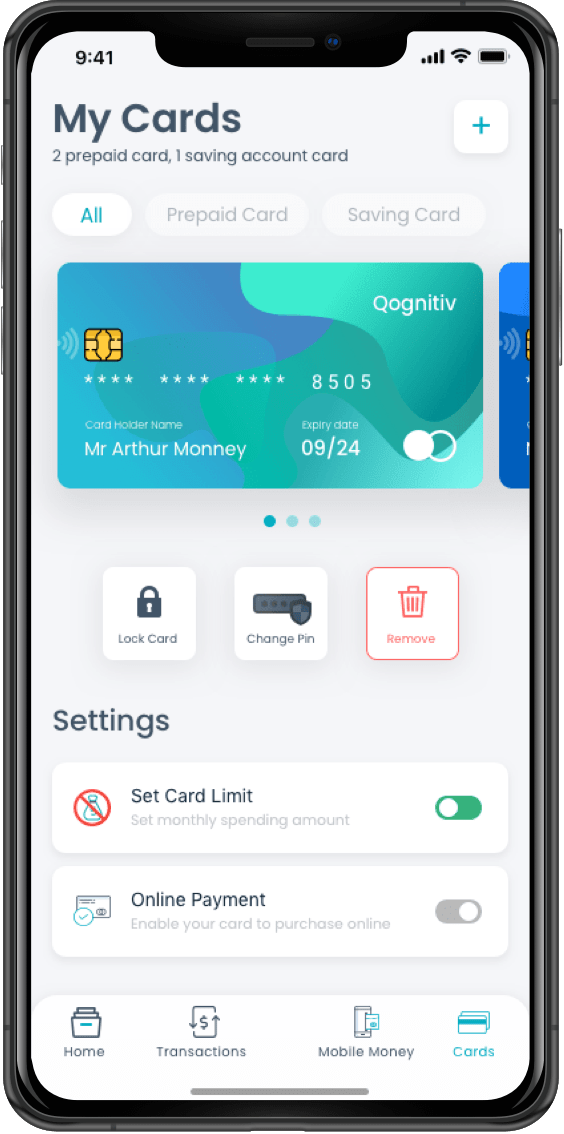

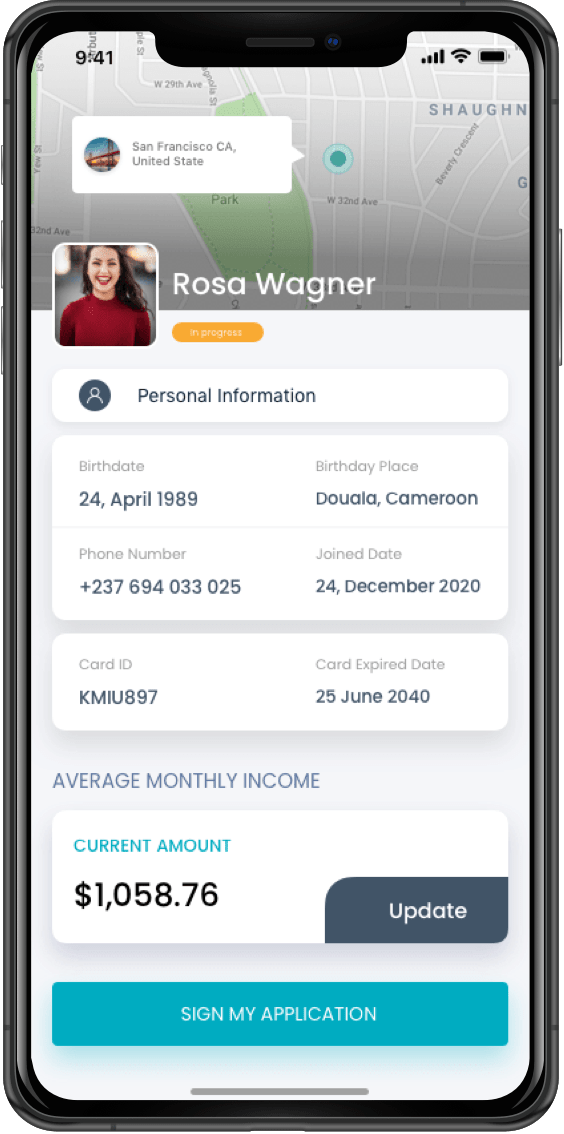

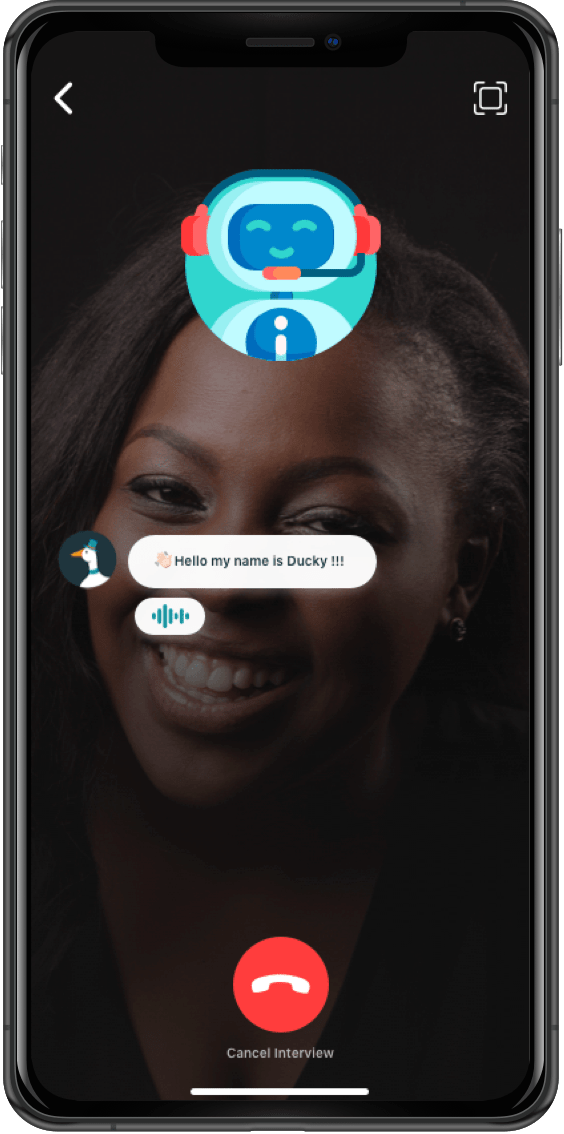

Mobile Application

Fully automated client on boarding, authentication through Face and Voice Recognition biometrics used to strengthen security, Realtime video chat with bank officers.

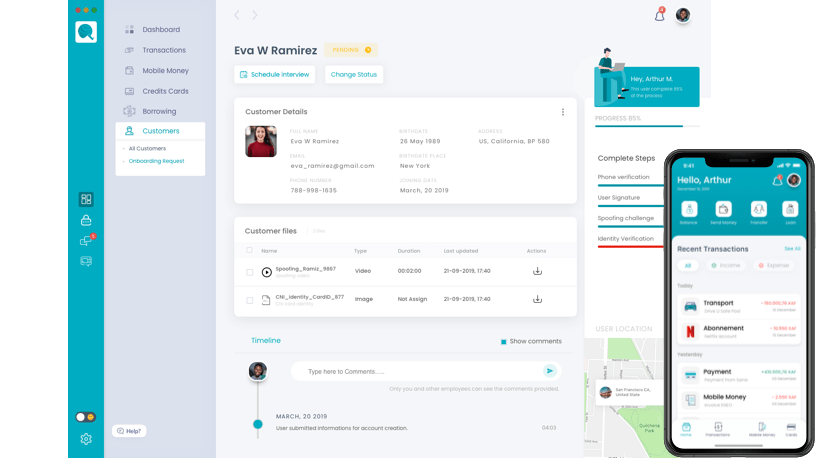

Administration

On boarding management, Customers management, KYC and compliance automated processes. Credit applications collection and risk assessment management, advanced analytics and reporting.

Core Banking

Manage digital services exposed to your clients. Integration with your existing core banking solution is done via secured API allowing export and import data between Qognitiv back office and your core banking software.

Money Transfer

Allow your customer to use worldwide famous money transfer services like Western Union, MoneyGram, RIA and others directly from the mobile application, increasing customers acquisition and engagement.

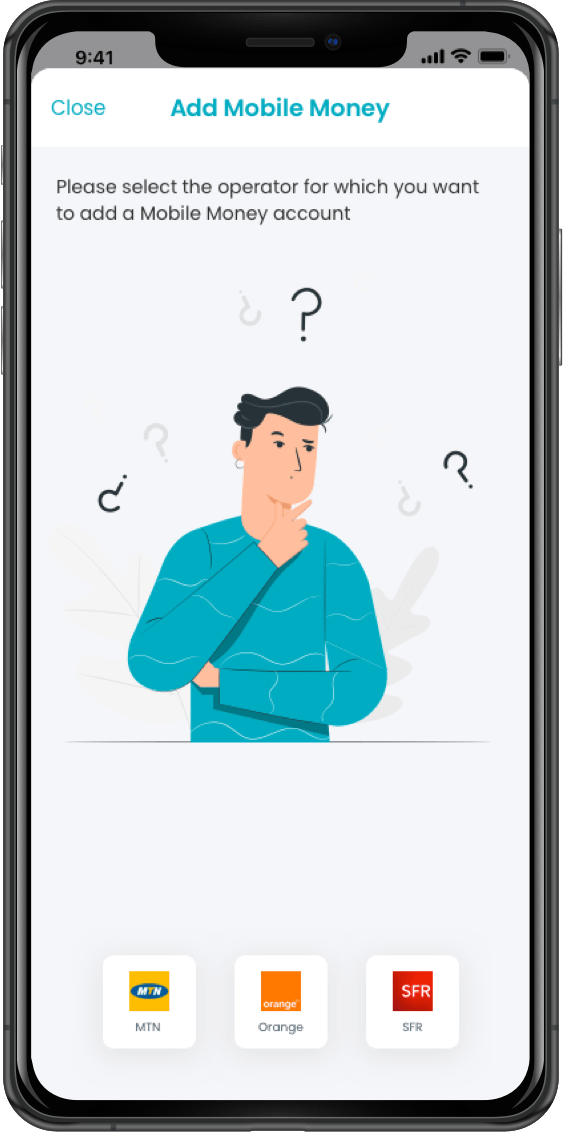

Mobile Money

Provide cash in and cash out services via connection with mobile money wallets, contributing in bank account deposit adoption and mobile money wallet fraud reduction due to extra layer of security for mobile money wallet protection.

Bill Payment

Qognitiv smart partner integration allows you to declaratively integrate any partner who want to provide bill or service payment to your mobile customers. This reduce time to market and simplify partner management.

Fraud Detection

Qognitiv fraud detection uses advanced in-house artificial intelligence algorithms to predict fraudulent transactions. using constantly improved model, the accuracy of fraud detection is maintained at a high value among best market standards.

Micro Credits

Qognitiv micro credit management allows your financial institution to automatically collect and run data mining on diverse sources, provide customer credit risk score using our artificial intelligence algorithms.

Why Qognitiv

Digital Bank StackQognitiv suite is a financial inclusion accelerator provider to retail banking and fintech using state of the art digital technologies with main focus on emerging markets.

Data privacy

Data protection and control is critical in banking industry. Qognitiv is deployed on your dedicated infrastructure and provides you full control on your customer data as no public cloud software is needed to run the software, all artificial intelligence algorithms are on premise solution without any third party requirement to run.

Low capex and opex costs

The conjunction of our powerful artificial intelligence algorithms and human experience driven by bank officer drastically increases the customer management per bank officer ratio, lowering to less than 1$ / year average bank account operational costs, increasing bank account adoption democratization.

Business alignment

Qognitiv stack has been designed to be completely modular allowing your institution to deploy only required services. Our high class level API provides a powerful interface to your own IT team to interact with Qognitiv suite and align your digital bank with your business strategy.

Financial education

Qognitiv carries out a high value added financial learning and savings education solution for unbanked and underbanked people, using social science and artificial intelligence algorithms to propose new modes of engagement using our smart assistant.

State of the art today’s technologies

Achieve operational excellence from day one without any additional development.

The human face is a dynamic object and has a high degree of variability in its appearance, which makes face detection a difficult problem in computer vision. Qognitiv face detection system achieves the task regardless of illumination, orientation, and camera distance. Qognitiv liveness detector is capable of spotting fake faces and performing anti-face spoofing in face recognition systems.

Artificial intelligence (AI) and Machine learning are taking the place of a human analyst very fast as inaccuracies which are involved in human selection may be very costly. Qognitiv AI is built upon machine learning which learns over time, less possibility of mistake and analyzing vast volumes of data to provide risk assessment and fraud detection and management services.

Know Your Customer (KYC), transactions, smart contracts and secure money transfer remittance relies on our in-house blockchain system which uses current state-of-the-art blockchain implementation, allowing secure transactions with external parties like money transfer services or mobile money partners.

Your own brand

Qognitiv Android and IOS mobiles applications are developed to handle large scale deployment, from UI/UX point of view, this has been achieved by building our own UI components. The styles are the factored out to be DRY.

REQUEST A DEMO

Qognitiv is designed for financial institutions (commercial banks, fintech and others) who want to leverage world class digital and artificial intelligence technologies to offer their customer powerful and modern digital services. Feel free to contact our team for better insights and we will be happy to revert back to you.

Languages and tools Insights

Modern, up to date cloud development technologies addressing digitalization challenges

Developers

Sky is the limit, we never doubt ourselves, staying focused, never let anything slow or stop us from concurring our goals and making our dreams happen!